- Charts of the Day

- Posts

- US Producer Prices rose by most in three years.

US Producer Prices rose by most in three years.

Traders are now leaning toward a 25 basis point cut in September.

Subscribe to receive these charts every morning!

1. US Producer Prices rose by most in three years. The Fed won't like this report.

A Labor Department report showed the Producer Price Index rose 3.3% on an annual basis in July, higher than the 2.5% gain expected.

This tempered bets on a larger, half-point cut next month.

Traders are now leaning toward a quarter-point move in September with another in October, reinforcing comments from Fed's Mary Daly that such a large cut is not needed.

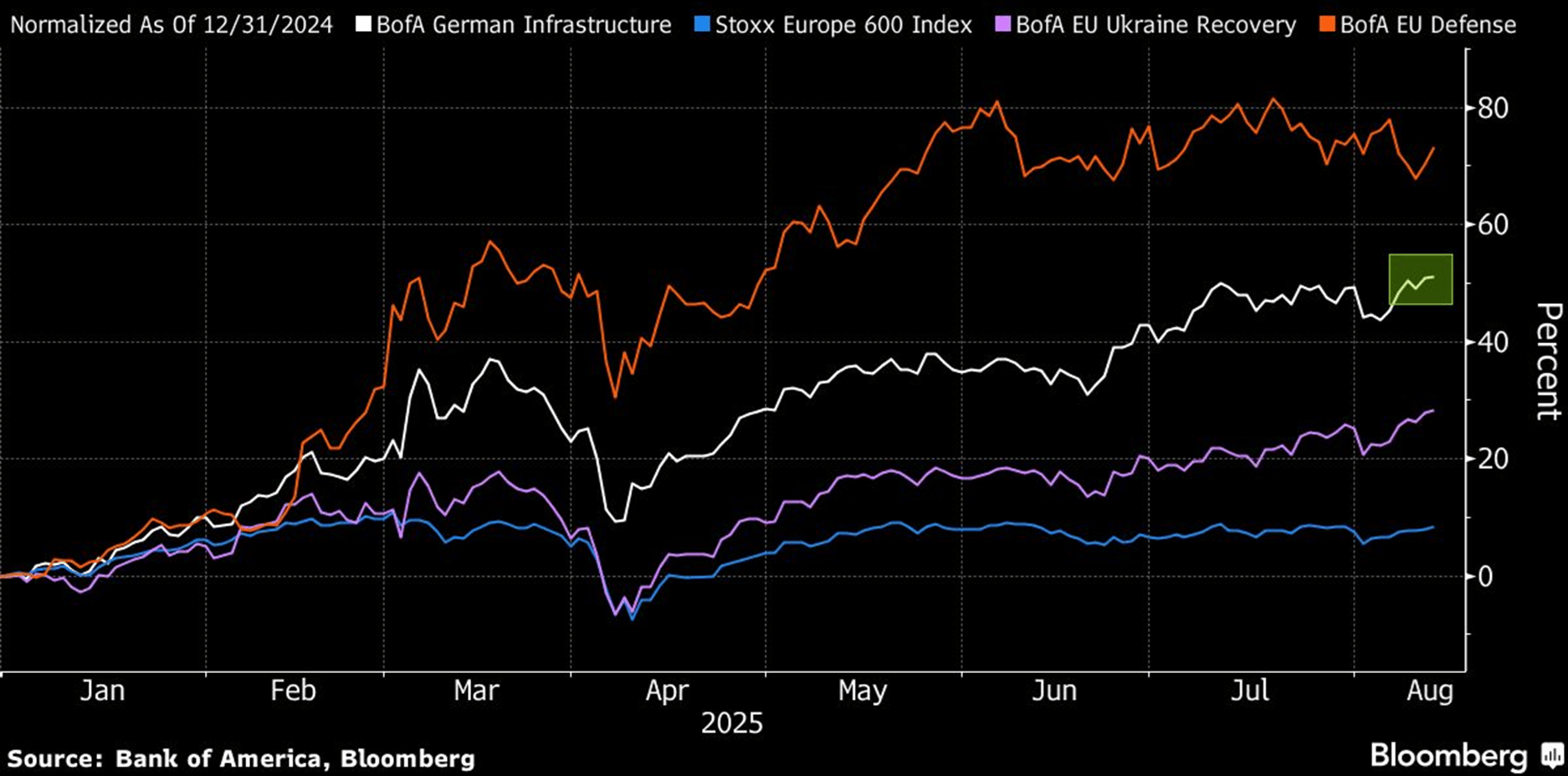

2. The European market has rewarded thematic investors this year, with defense and infrastructure the big winners.

A Bank of America basket of European stocks geared to German infrastructure has soared 50% since the start of 2025, and has started to challenge rallying defense stocks in the past two months. Prospects of truce talks between Ukraine and Russia have also spurred these names, seen as likely reconstruction beneficiaries. The infrastructure theme has gathered momentum as it becomes clearer that the German government is about to spend on this area like it rarely has before. Large industrial, energy, construction, metals and services companies are part of the BofA basket, including Siemens, Heidelberg Materials, Eiffage, Daimler Truck and Thyssenkrupp.

3. The boost to companies from German spending is not yet reflected in earnings estimates or valuations.

For 2025, the German government has announced an increase in investment commitments to €115 billion, up 55% on last year. By 2029, federal outlays will rise to almost €120 billion annually. Rail, digital transformation, renewable energy, urban development, as well as housing are all targeted.

4. “German sentiment has improved, as evidenced in better readings in surveys like the Ifo and the PMI, but it will take time for fiscal stimulus to feed through to the real economy.”

Below: Corellation between the IFO and the German midcap index.

5. The market feels like a melt-up, Ed Yardeni says.

Not a subscriber yet?

How was today's Edition?What can we improve? We would love to have your feedback! |

Reply