- Charts of the Day

- Posts

- US stock futures down on Fed independence concerns.

US stock futures down on Fed independence concerns.

Jerome Powell said threats of a criminal indictment were a consequence of its interest-rate policies.

1. Breaking news: Fed Chair Powell responds after Federal prosecutors open a criminal investigation into him.

“The threat of criminal charges is a consequence of the Fed setting rates based on our best assessment of what will serve the public, rather than following the preferences of the President,” he says.

The move marks an escalation of President Donald Trump’s longstanding feud with the Fed chair.

“This environment is likely to accelerate capital outflows from US equities toward emerging markets, creating significant headwinds for further upside in US risk assets,” said Gerald Gan, chief investment officer at Singapore-based Reed Capital Partners.

2. Earnings season kick-off with US banks.

Major US banks are set to report strong earnings growth.

A surge in investment banking revenue as dealmaking accelerates is expected to bolster the banks' fourth-quarter results, while investors will focus on their commentary related to consumer spending as a crucial read into the broader economy's health.

Overall S&P 500 earnings are expected to have climbed about 9% in the fourth quarter from the year-earlier period, according to LSEG IBES, with investors anticipating another year of strong U.S. profit growth in 2026.

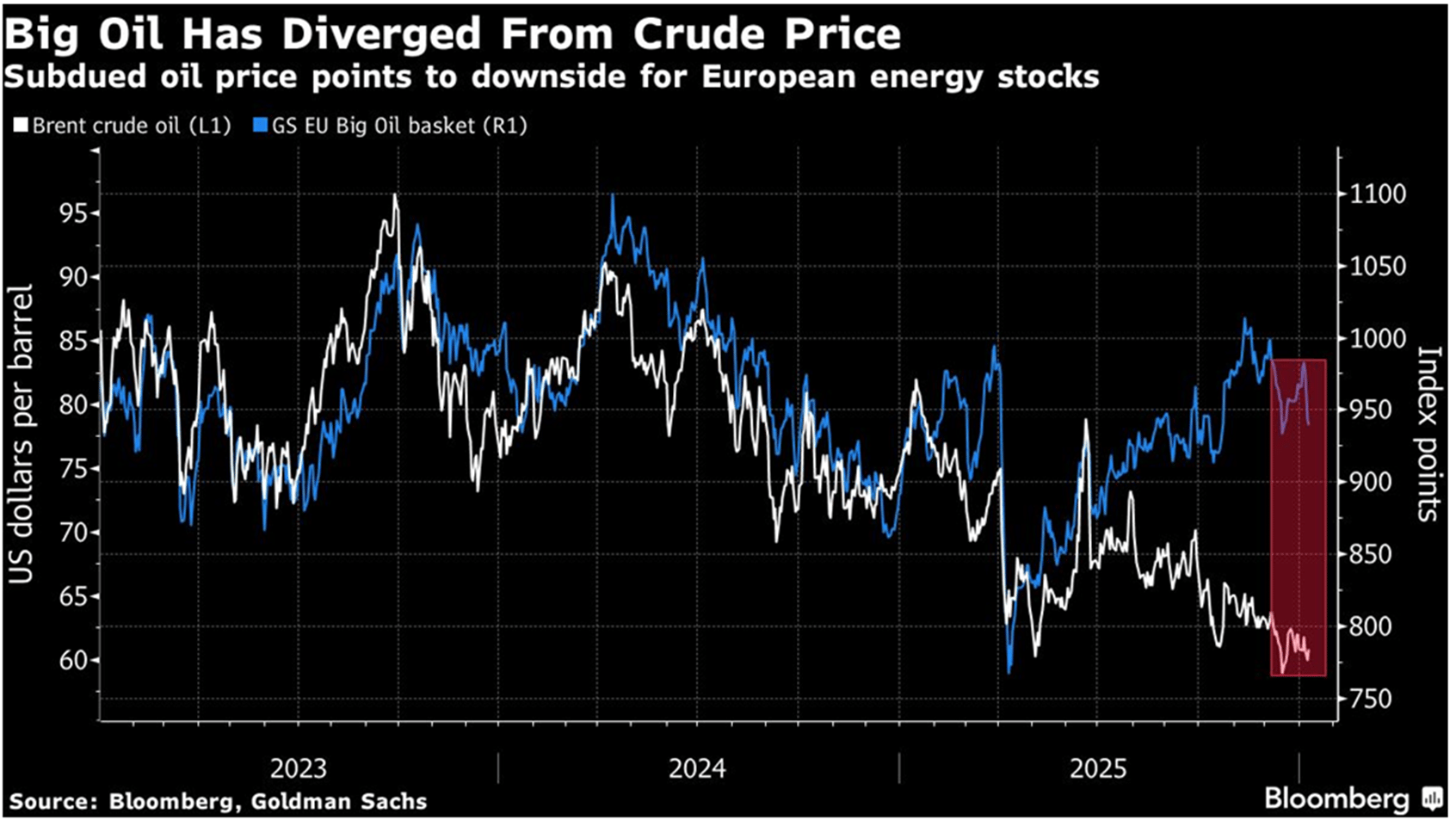

3. The outlook for Europe’s oil companies is darkening rapidly.

Oversupply and rising costs threaten to erode earnings and returns for investors who already face demanding share valuations. Brent trades with a $60 handle, down more than 25% from its peak about a year ago.

A gap between oil stocks and crude prices that opened last year is widening, and risks are skewed to the downside.

After the removal of Nicolas Maduro, President Donald Trump said the US would run Venezuela and extract its oil for years. The flow of those barrels to American buyers could prove one of the most significant shifts in global energy markets in recent years. It’s likely to keep weighing on oil prices that already reflect a surplus, further stretching balance sheets.

4. And that’s not the only oversupply…

Europe is moving into LNG-driven structural surplus as global LNG market expands by 40% by 2030. The downward pressure on gas prices could resume and intensify in 2026/27, driven by a particularly large expansion of global LNG supply.

Gas prices have been under pressure for most of the past year, dropping from €50/MWh on Jan 1st 2025 to €28/MWh today.

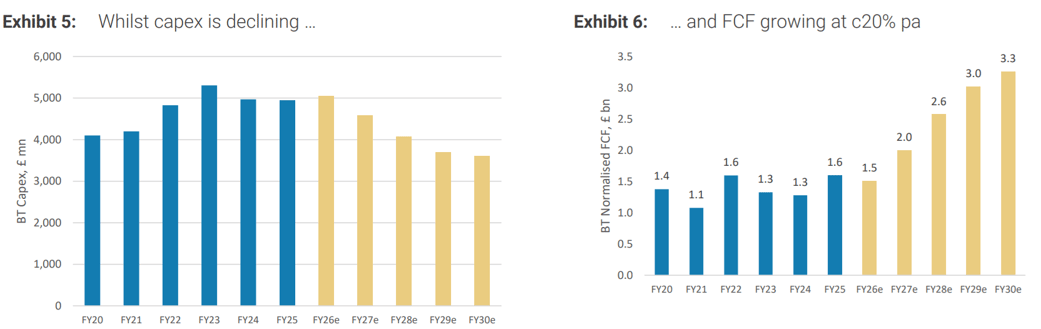

5. Goldman sees 'sustained growth step-up' for EU telcos in 2026.

Goldman Sachs reaffirms its bullish 2026 outlook for the European telecom sector, citing sustained growth potential in digital infrastructure.

Organic growth from fibre deregulation and concentrated mobile markets supports a "sustained growth step-up" not yet reflected in consensus, GS says.

"Inorganically, mobile consolidation remains a key upside catalyst," adding that operators are optimistic about receiving EU approval.

Below: After years of heavy capex in fibre, telecom infrastructure is getting monetised.

Not a subscriber yet?

How was today's Edition?What can we improve? We would love to have your feedback! |

Reply