- Charts of the Day

- Posts

- US Stock Futures jump on China trade deal progress.

US Stock Futures jump on China trade deal progress.

US: Moderate inflation helps pave way for upcoming rate cuts.

Subscribe to receive these charts every morning!

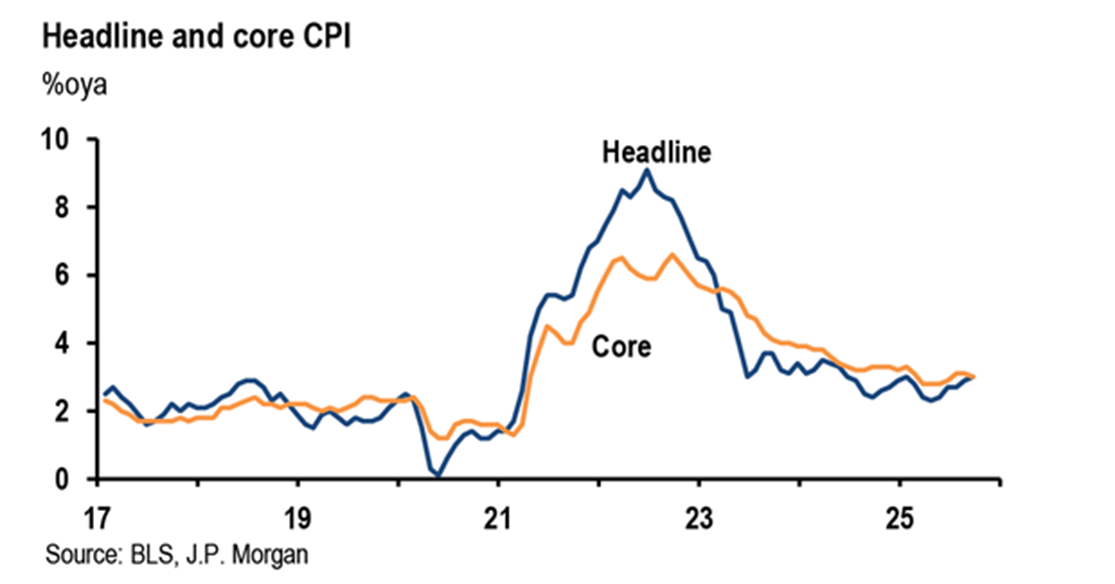

1. US: Moderate inflation helps pave way for upcoming rate cuts.

Core CPI rose 3.0%, a bit below expectations.

While inflation is continuing to run above the Fed’s target the latest reading should make it more comfortable with continuing to cut rates past the October meeting.

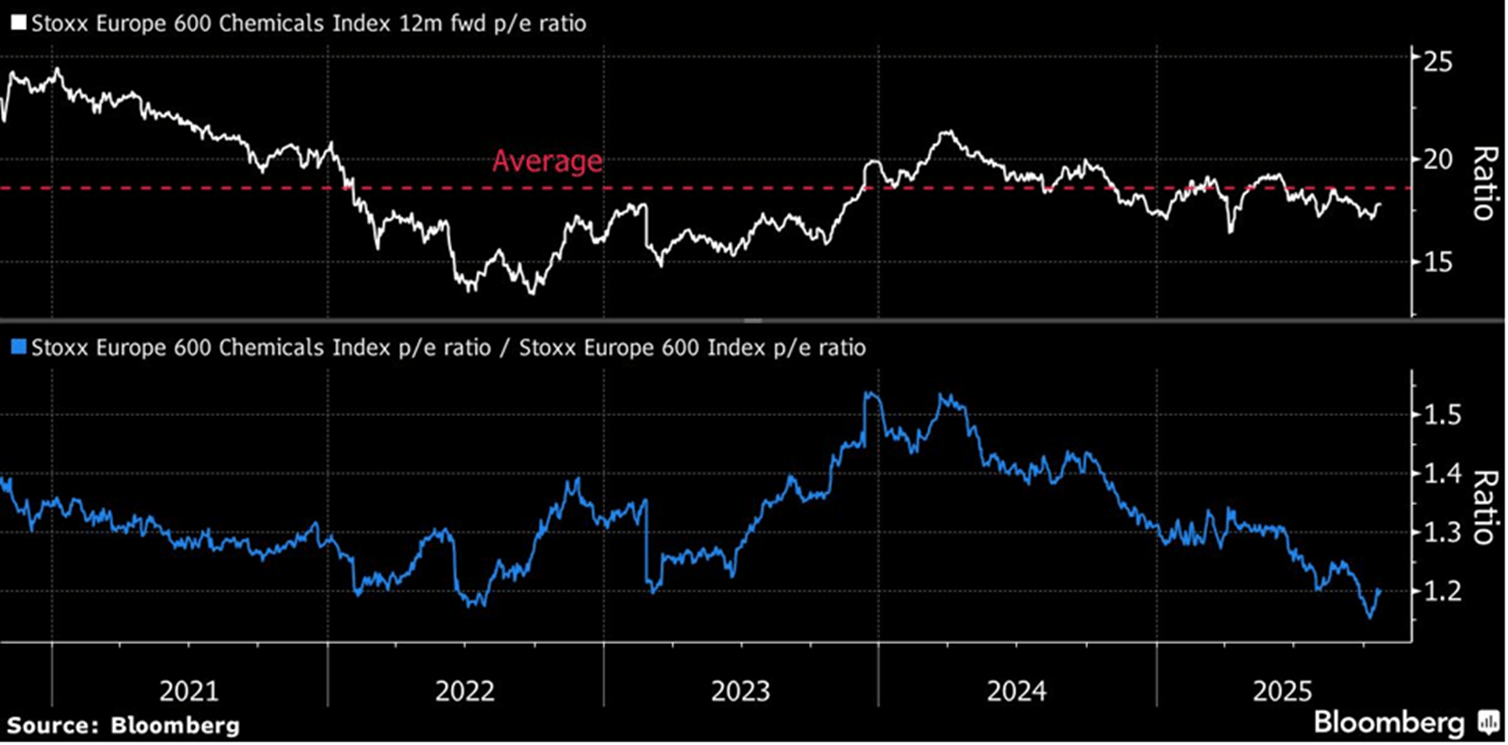

2. What about chemicals?

The sector is on course to sharply underperform the pan-European Stoxx 600 for a second year. It has failed to shake off oversupply issues and sluggish sales, with US tariffs and a weaker dollar extending a list of woes.

For the sector to rebound, demand must pick up from key customers, particularly in autos and construction. The auto industry alone accounts for roughly a quarter of Europe’s chemicals consumption, but remains under strain as manufacturers struggle to compete with Chinese electric vehicle brands and confront US tariffs.

Still, Barclays and JPMorgan strategists are overweight on the sector, arguing that a phase of de-stocking is over and that volumes should bounce in the coming quarters. Stabilizing natural gas prices are a tailwind, and recent underperformance in chemicals stocks presents a tactical opportunity. The sector trades at 17.8 times forward earnings, below its own average for the past five years.

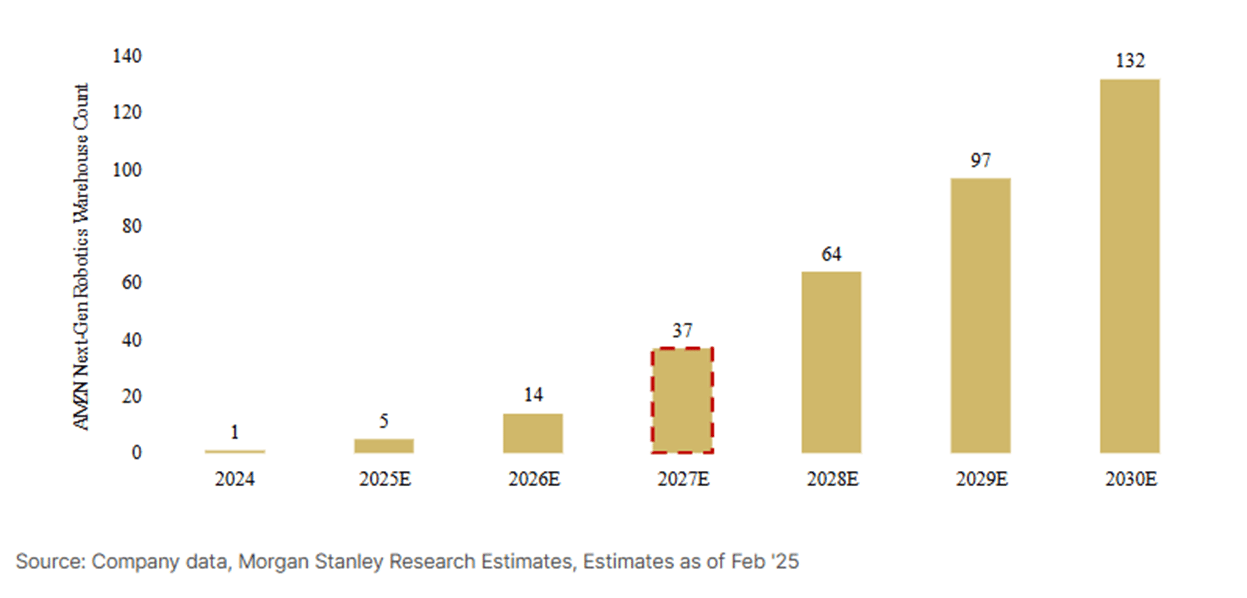

3. Amazon is planning to add ~40 next-gen robotics warehouses by the end of '27.

AMZN's automation team expects the company can avoid hiring 160k+ US warehouse employees by '27 from this build out, and that this in turn may drive $10bn of savings.

And that’s just the beginning.

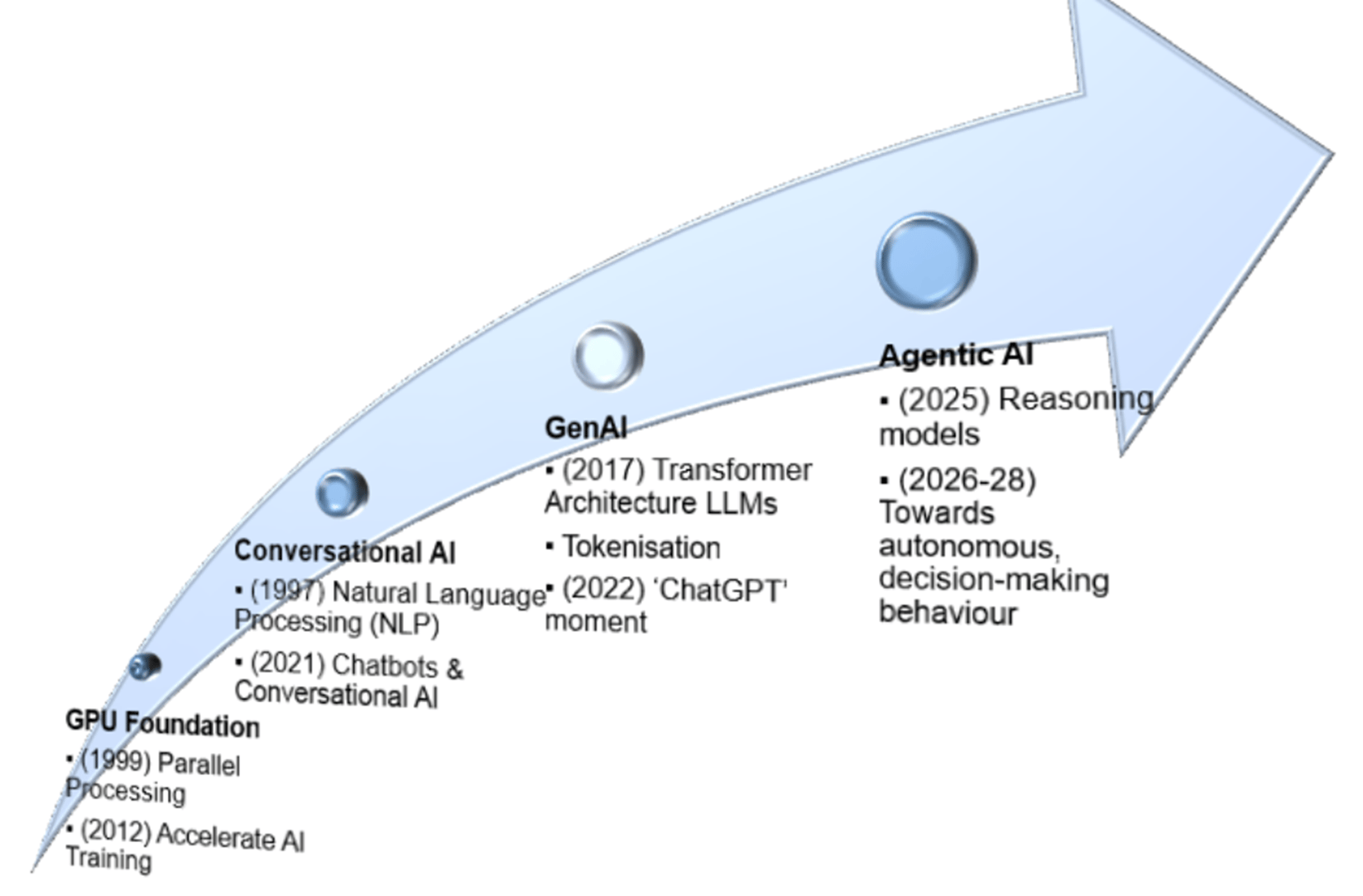

4. The Evolution of AI.

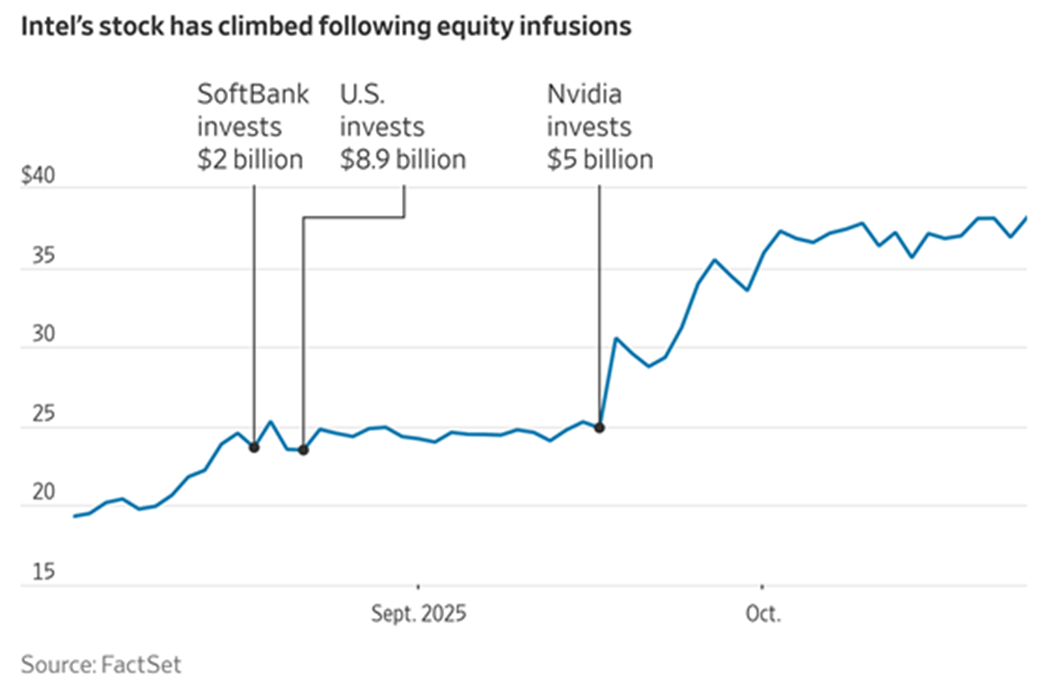

5. Intel’s stock has almost doubled this year following big cash infusions.

Intel's importance for national security, for the American high-tech economy and for the competitiveness of the cutting-edge chip market are a big part of what’s keeping the storied chip maker afloat these days.

That doesn't mean it will succeed. What Intel badly needs now isn’t just money and confidence, but something out of its control: It needs TSMC’s chip advances to falter, much like Intel’s faltering allowed TSMC to take the lead years ago. That would also give potential customers an incentive to diversify their supplier base.

Not a subscriber yet?

How was today's Edition?What can we improve? We would love to have your feedback! |

Reply