- Charts of the Day

- Posts

- US stocks rise as tech concerns subside.

US stocks rise as tech concerns subside.

Software stocks are near “capitulation territory".

1. US manufacturing output posts big increase of 0.7% and was broad-based.

Economists are optimistic the boost from AI will further broaden to the rest of manufacturing.

2. European and international equities outperform US equities.

Resurgent optimism about Europe and the benefits of German stimulus is driving investment flows into the region’s equity markets and fueling an outperformance that is expected to last.

“Within developed markets, US equities have underperformed both Japanese and European stocks — a trend we expect to persist,” say JPMorgan strategists led by Mislav Matejka.

Euro-area stocks offer compelling relative valuations, light positioning and stand to gain from increased fiscal spending, they say.

3. Value takes the lead over growth.

The rally in value stocks across the globe, powered by rising economic growth expectations, bodes well for Europe.

The Stoxx 600 typically outperforms the S&P 500 when value takes the lead over growth, which has been the case in the past few months.

Fears about excessive spending on artificial intelligence, especially by US megacaps, is keeping investors cautious toward the growth cohort.

Rotation into value stocks has further to go, given the extreme nature of their prior underperformance, while valuations remain undemanding.

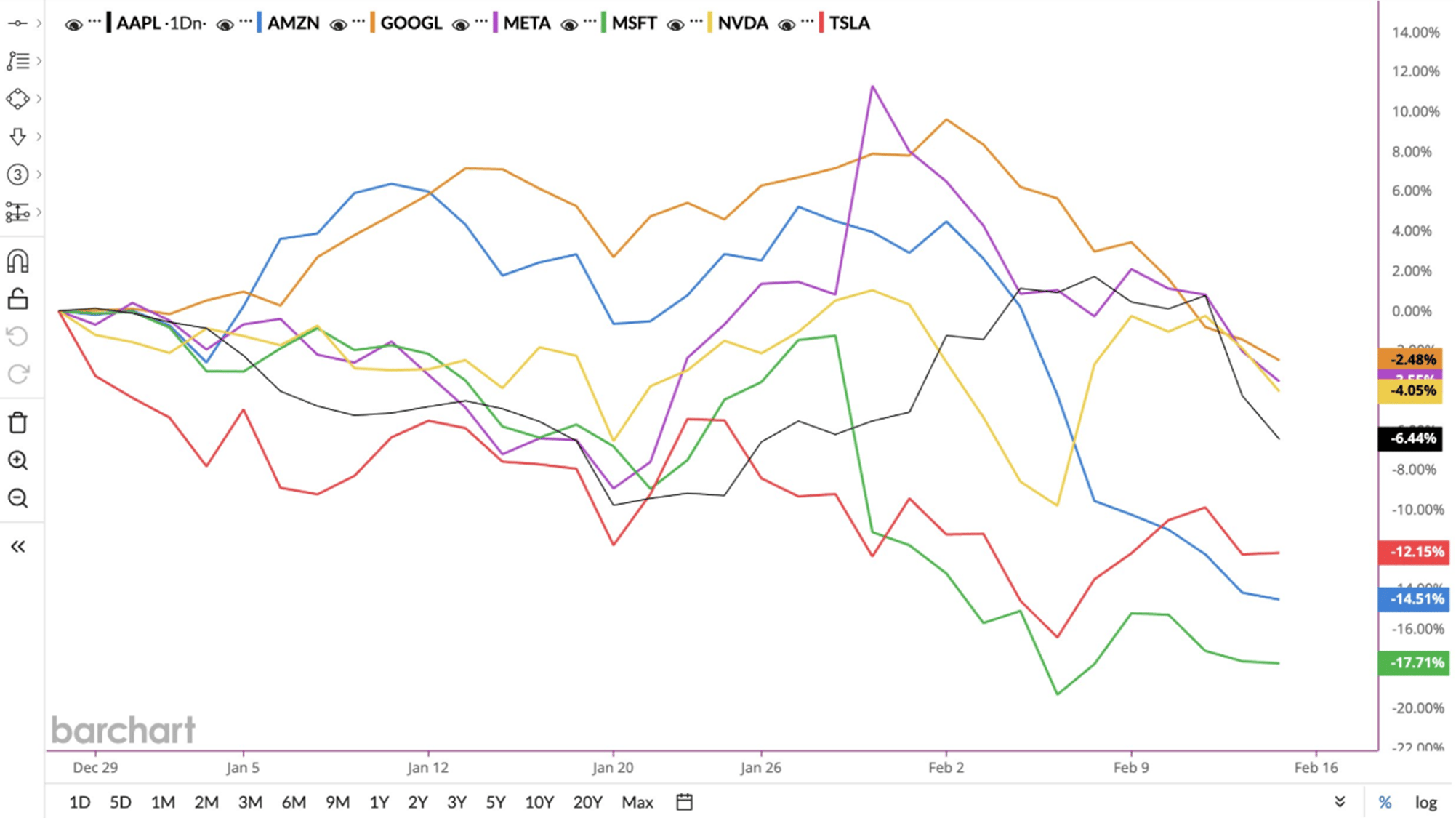

4. MAG7 all red year-to-date.

5. Reusable rockets have catapulted the economy into the space age.

Thanks to SpaceX, the annual upmass to orbit has hit record highs. With more than 9,000 active Starlink satellites, SpaceX accounts for ~66% of all active satellites orbiting Earth.

According to Wright’s Law, satellite bandwidth costs should decline by ~44% for every cumulative doubling of gigabits per second (Gbps) in orbit, enabling satellite connectivity to complement cell towers and deliver ubiquitous mobile coverage across the US.

Not a subscriber yet?

How was today's Edition?What can we improve? We would love to have your feedback! |

Reply